Short summary

What happens when U.S. entities can no longer launder funds abroad?

When major Caribbean financial havens tightened anti–money-laundering (AML) rules in 2009, U.S. illicit funds could no longer flow as easily through those jurisdictions. According to recent research U.S. counties most connected to these offshore centers before the reform saw a rise in new business establishments just after the regulations took effect, particularly in cash-intensive sectors and real estate. These patterns suggest that tougher rules abroad can displace laundering rather than deter it, highlighting the need for coordinated policies that close loopholes across borders.

Key Findings

- U.S. counties more exposed to Caribbean AML reforms saw a clear drop in offshore links after 2009, indicating that access to foreign laundering channels declined.

- In the same counties, the number of local business establishments increased just after the reform, especially in cash-intensive sectors and real estate.

- Back-of-the-envelope calculations suggest that the reform generated around 47,000 additional U.S. businesses, worth 14 billion dollars in total.

- The new firms tended to hire fewer workers and displayed unusually high revenues per employee, a pattern typical of front companies.

- In exposed areas, cash purchases of property became more common, pointing to price manipulation consistent with laundering through real assets.

- The effects were strongest in counties involved in drug trafficking and declined with travel distance, suggesting that once the offshore channel was closed, illicit funds were laundered locally.

Relevance Today

Global anti–money-laundering initiatives are increasingly targeting banks, tax havens, and cryptocurrency markets. Yet our research shows that when enforcement focuses narrowly on offshore or financial channels, illicit funds can resurface domestically, often in small front companies and real estate. The results highlight how AML regulations abroad can have unintended consequences at home if coordination is lacking. Effective AML enforcement must therefore link offshore supervision with stronger domestic monitoring.

Authors Quote

“Our results suggest that tougher rules abroad alone are not enough to curb laundering overall.

To be effective, anti–money-laundering policies must be coordinated across borders and across sectors.”

Reference

Based on RFBerlin Discussion Paper No. 85/25 “Unintended Consequences of Anti-Money-Laundering Regulations”; forthcoming in the Economic Journal.

Research summary

Colella, Maskus, and Peri (2025) study how anti–money-laundering regulations in offshore financial centers can create unintended domestic effects. In 2009, major Caribbean havens tightened their AML frameworks following the Caribbean Financial Action Task Force’s mutual evaluations. Data from the International Consortium of Investigative Journalists (ICIJ) reveal that counties more exposed to the reforms lost offshore links but gained new businesses at home. The expansion was concentrated in cash-intensive sectors and among establishments with few workers and high revenues per worker, suggesting that part of the illicit activity displaced from offshore centers resurfaced domestically.

Policy Challenge: From Offshore to Onshore Risks

Money laundering remains a major concern for regulators worldwide. Most countries have strengthened anti–money-laundering frameworks and improved international cooperation to curb illicit financial flows (Geiger and Wuensch, 2007). These initiatives have made progress in limiting the use of offshore secrecy, yet the equivalent of about 10 percent of world GDP is still held in tax havens (Alstadsæter, Johannesen, and Zucman, 2018). At the same time, recent evidence shows that global AML reforms can significantly alter international investment patterns (Agca, Slutzky, and Zeume, 2021). However, little is known about whether such offshore crackdowns lead to a reallocation of illicit activity into domestic business activities.

AML regulations have expanded dramatically over the past two decades. Yet international bodies such as the Financial Action Task Force warn that when one laundering channel is closed, criminals often adapt by shifting to another. Until now, however, direct evidence of this leakage has been scarce. The 2009 Caribbean Financial Action Task Force (CFATF) reforms provided a natural experiment. These reforms targeted jurisdictions such as Bermuda, the Cayman Islands, and the Bahamas— places long known for providing offshore vehicles to conceal illicit wealth. Using newly available data on U.S. county-level links to these havens, the study tracks what happened when the financial door to the Caribbean began to close.

In 2009, the Caribbean Financial Action Task Force (CFATF) launched a series of mutual evaluations that led its member jurisdictions — including Bermuda, the Cayman Islands, and the Bahamas — to strengthen their anti–money-laundering frameworks. These reforms required banks, law firms, and other financial intermediaries to apply stricter reporting standards. To trace U.S. links to these offshore centers, the study relies on data released by the International Consortium of Investigative Journalists, which document connections between U.S. entities and firms registered in tax havens before the reforms. This information makes it possible to identify which U.S. counties were most exposed to the tightening of AML rules in the Caribbean.

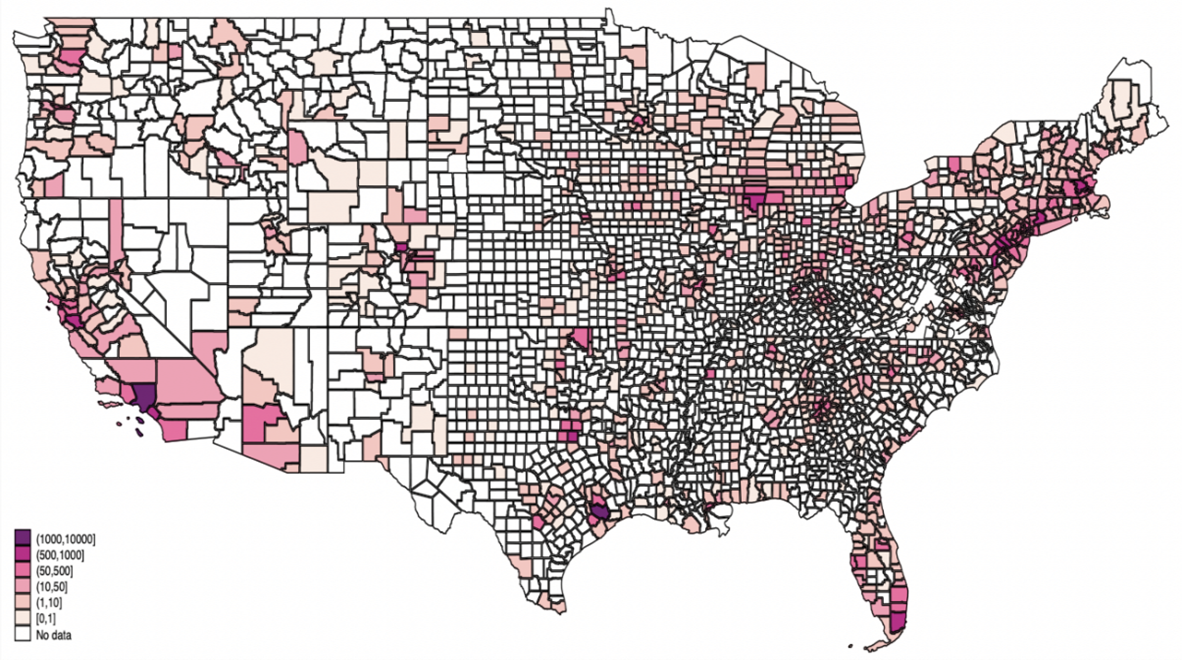

Figure 1. Geographic Distribution of Exposure to Caribbean AML Reforms

Counties with more pre-2005 links to jurisdictions that later strengthened their AML frameworks are more exposed to the 2009 CFATF reforms. Darker red shades indicate higher exposure based on ICIJ data. Exposure is concentrated along the coasts and in major financial centers.

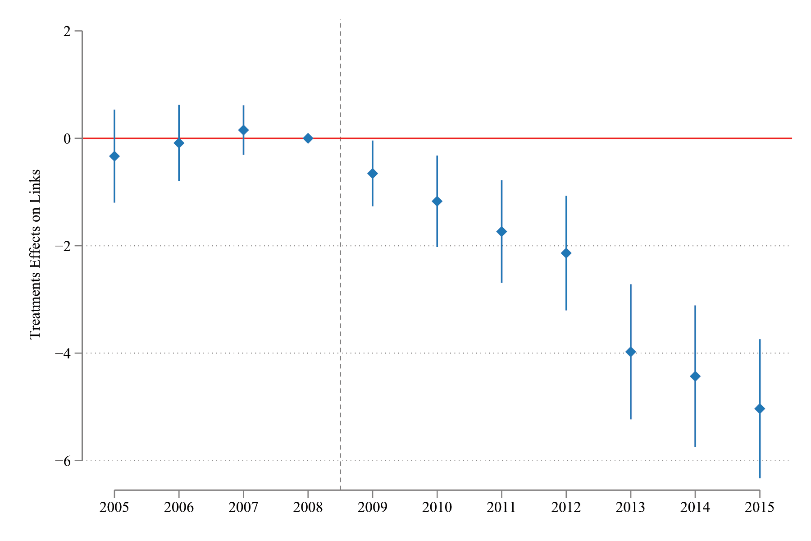

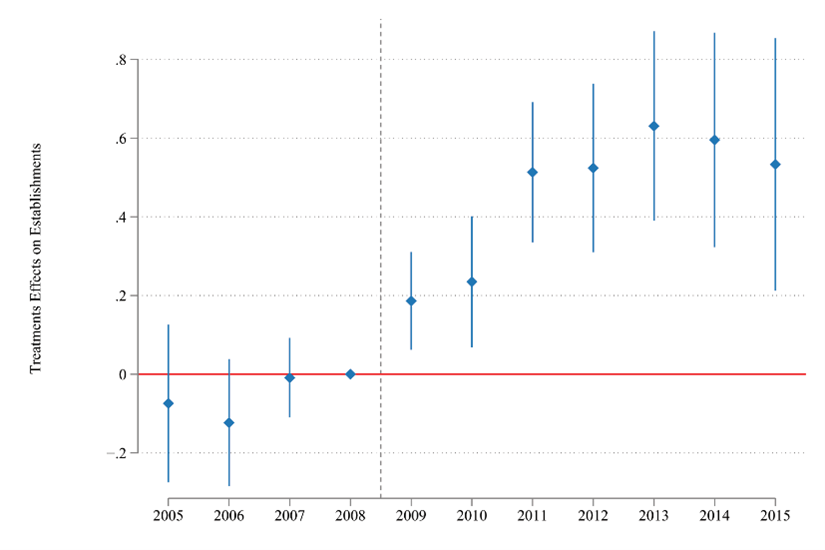

The Impact of the Caribbean Financial Action Task Force on Business Activity in the United States

Counties that were more exposed to the 2009 Caribbean anti–money-laundering reforms experienced a sharp and persistent decline in their offshore connections. Figure 2(a) presents the estimated effects showing that, relative to less exposed counties, the number of offshore links began to fall immediately after 2009 and continued to decline in the following years. This result indicates that the tightening of AML rules in Caribbean jurisdictions effectively curtailed access to foreign laundering channels for U.S. entities. At the same time, U.S. counties that lost more offshore links saw an increase in the number of local business establishments. Figure 2(b) shows that business activity rose shortly after the reforms, with the timing mirroring the drop in offshore connections. The effect is concentrated in sectors where cash transactions are common, such as retail, accommodation, and construction, and areas with pre-existing exposure to illicit financial flows.

Taken together, these patterns suggest a replacement process rather than a general expansion of legitimate business activity. When access to offshore laundering routes is restricted, illicit funds re-enter the domestic economy through newly created firms, altering local business dynamics even though overall production or employment may not rise. Quantitatively, the results imply that counties with previous links to the affected jurisdictions reduced offshore connections by 3 percent and increased the number of local establishments by about 0.6 percent. Scaled to the national level, these effects correspond to roughly 47,000 additional U.S. firms with a combined value of around 14 billion dollars.

Figure 2. Effects of the CFATF Reforms on Offshore Links and Business Establishments

Panel A

Panel B

Panels (a) and (b) report regression coefficients on the number of offshore links and on the logarithm of the number of business establishments, respectively. U.S. counties more exposed to the 2009 Caribbean AML reforms experienced a sharp decline in their offshore links, and a simultaneous rise in the number of local business establishments in those counties.

Lessons for policy makers

Money laundering remains at the center of global policy debates, as governments seek to safeguard financial integrity and prevent illicit flows. The results show that anti–money-laundering crackdowns in offshore centers can shift illicit activity to domestic channels instead of eliminating it. To be effective, AML enforcement must coordinate across borders and sectors, linking offshore supervision with stronger oversight of company formation, cash-intensive businesses, and real-estate transactions. Without such coordination, tougher rules abroad risk displacing rather than reducing money laundering.

Conclusion

This study provides the first systematic evidence of cross-border money-laundering leakage. Efforts to clean up financial havens abroad may strengthen, rather than weaken, laundering activity domestically. The lesson is that only coordinated action across borders can help to reduce global money laundering.

References

Agca, S., Slutzky, P., and Zeume, S. (2021). Anti-money laundering enforcement, banks, and the real economy. SSRN 3555123.

Alstadsæter, A., Johannesen, N., and Zucman, G. (2018). Who owns the wealth in tax havens? Macro evidence and implications for global inequality. Journal of Public Economics, 162:89–100.

Geiger, H. and Wuensch, O. (2007). The fight against money laundering: An economic analysis of a cost-benefit paradoxon. Journal of Money Laundering Control.

Disclaimer

The opinions and views expressed in this publication are those of the author(s) and do not necessarily reflect those of the ROCKWOOL Foundation Berlin (RFBerlin). While research disseminated through this series may address policy-relevant topics, RFBerlin, as an independent research institute, does not take institutional policy positions.

Publications in the RFBerlin Research Insights series may represent preliminary or ongoing work that has not been peer-reviewed. Readers are advised to consider the provisional nature of such research when citing or applying its findings.

These publications aim to make scientific work accessible to a broader audience and to encourage informed, research-based discussion. All materials are provided by the respective authors, who bear responsibility for appropriate attribution and rights clearance. While every effort has been made to ensure accuracy and proper acknowledgment, RFBerlin welcomes notifications of any concerns regarding authorship, citation, or intellectual property rights. Please contact RFBerlin to request corrections if needed.

Use of these materials for the development or training of artificial intelligence systems is strictly prohibited.